who pays transfer tax in philadelphia

Transfer Tax on Real Estate One percent is collected by the Commonwealth of Pennsylvania while 3278 percent is collected by the City of Philadelphia for a combined total. The locality charges a second fee usually totaling about.

Philadelphia Real Estate Transfer Tax Certification City Of Philadelphia Phila Fill Out Sign Online Dochub

Luckily it is customary but not legally.

. The state of Pennsylvania charges one. It is important to know when you may be eligible for one of the many transfer tax exemptions. The PA deed transfer tax is generally about 2 of the final sales price which consists of two different sets of fees.

Luckily it is customary but not legally. Transfer Tax on Real Estate One percent is collected by the Commonwealth of Pennsylvania while 3278 percent is collected by the City of Philadelphia for a combined total. How Do I Calculate Transfer Taxes In Philadelphia.

Consider the transfer tax sometimes known as a tax stamp to be a type of sales tax on real estate. Pennsylvania imposes a 1 transfer tax on the value of the real estate being transferred while Philadelphia imposes a 3278 tax on the value of the real estate being. Most tax payments can be made.

Transfer tax is usually paid by the seller when the property ownership is transferred to the buyer although there are cases where a buyer may take on the expense. The Realty Transfer Tax is a 3278 tax on the total consideration usually sale price when a property is transferred to a new owner an. How much are transfer taxes in PA.

Philadelphia Realty Transfer Tax. Solution When you submit the sale document for recording you will be required to pay the Real Estate Transfer Tax. Buyer Closing Costs Philadelphia Home 750000 purchase price 20 down payment Pennsylvania Realty Transfer Tax 3750.

Realty Transfer Tax The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278. Our offices can work with you to determine if your real estate transaction may qualify and can help. Realty Transfer Tax The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278.

Current participants of our ACH Debit payment program can continue to use ACH Debit to pay all other City taxes until September 20 2022. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed instrument long-term. Who pays Philadelphia transfer tax.

324 South 52nd Street Philadelphia Pa 19143 Compass

New York State S Real Estate Transfer Tax The Cpa Journal

Worries Remain Regarding Philly Tax Income Whyy

Real Estate Transfer Taxes Deeds Com

Real Estate Transfer Tax What Are They Where Does The Money Go

Pennsylvania Deed Transfer Tax 2022 Rates By County

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Taxes Archives Valley Of Heart S Delight Blog

Transfer Tax Calculator 2022 For All 50 States

Philadelphia Property Tax Bills Are In The Mail Department Of Revenue City Of Philadelphia

3231 W Berks St Philadelphia Pa 19121 Mls Paph2151782 Trulia

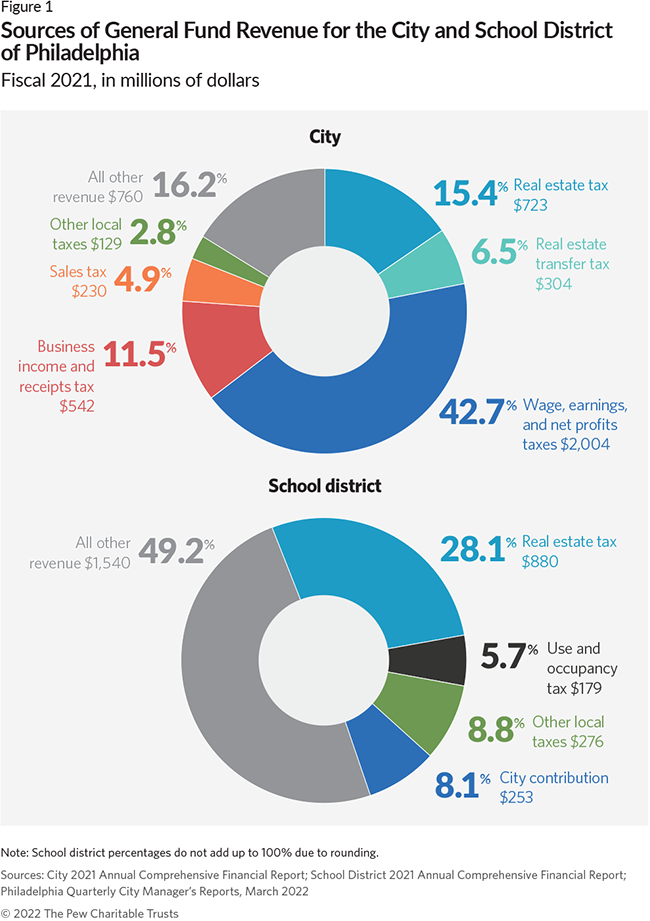

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

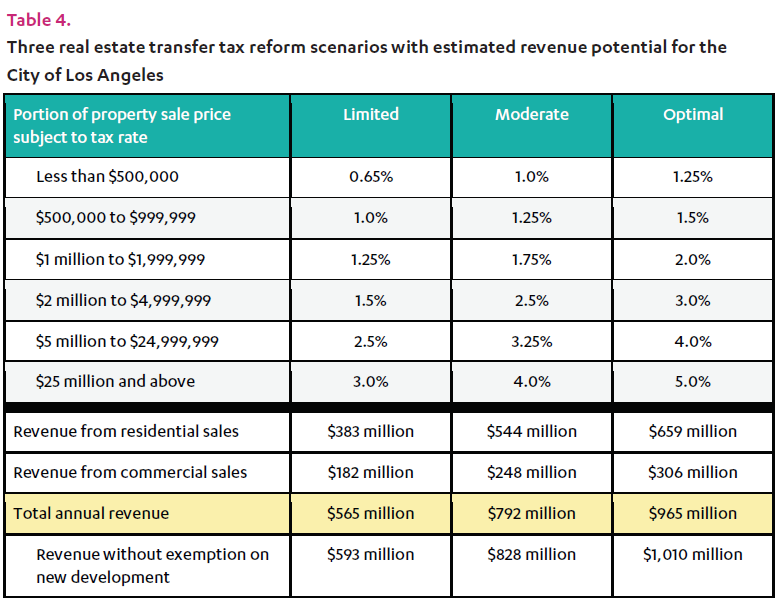

Building A More Equitable California With Transfer Tax Reform Better Institutions

Transfer Tax What Is It Philadelphia Mortgage Brokers

Free Pennsylvania Quit Claim Deed Form Pdf Word Eforms

Closing Costs In Philadelphia Pa When Selling A Property

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa